Janet L. Yellen

Inflation Dynamics and Monetary Policy

September 24, 2015

You see original and all speech from this link. Keeping

inflation stable at a moderately low level is important in 1980’s and 1990’s.

Nowadays , this idea is changed because USA needs more and more inflation (same

as after the great recession 1930’s)

Firstly,

I need to indicate, FED works on (PCE) personal consumption expenditures. This

is the measure of inflation in USA.

Please be careful, it is not PCI. FED concentrates core inflation which

excludes food and energy prices.

Yellen speaks now. Firstly, we need to

take lesson of inflation history.

Today many economists believe that these features of

inflation in the late 1960s and 1970s--its high level and lack of a stable

anchor--reflected a combination of factors, including chronically overheated

labor and product markets, the effects of the energy and food price shocks, and

the emergence of an “inflationary psychology” whereby a rise in actual

inflation led people to revise up their expectations for future inflation.

Together, these various factors caused inflation--actual and expected--to

ratchet higher over time.

Yellen

more concrete indicated that low inflation may be a indicator of bad economic

situation.

United States has experienced very low inflation on

average since the financial crisis, in part reflecting persistent economic

weakness that has proven difficult to fully counter with monetary policy.

Why

does FED use core inflation ?

Food and energy prices can be extremely volatile, with

fluctuations that often depend on factors that are beyond the influence of

monetary policy, such as technological or political developments (in the case

of energy prices) or weather or disease (in the case of food prices). As a

result, core inflation usually provides a better indicator than total inflation

of where total inflation is headed in the medium term. As a result, core

inflation usually provides a better indicator than total inflation of where

total inflation is headed in the medium term. Of course, food and energy

account for a significant portion of household budgets, so the Federal

Reserve’s inflation objective is defined in terms of the overall change in

consumer prices.

What

are reasons for core inflation tends to fluctuate around a longer-term trend ?

Such deviations of inflation from trend depend partly

on the intensity of resource utilization in the economy—as approximated, for

example, by the gap between the actual unemployment rate and its so-called

natural rate, or by the shortfall of actual gross domestic product (GDP) from

potential output. This relationship--which likely reflects, among other things,

a tendency for firms’ costs to rise as utilization rates increase--represents

an important channel through which monetary policy influences inflation over

the medium term, although in practice the influence is modest and gradual.

Movements in certain types of input costs,

particularly changes in the price of imported goods, also can cause core

inflation to deviate noticeably from its trend, sometimes by a marked amount

from year to year.

Finally, a nontrivial fraction of the

quarter-to-quarter, and even the year-to-year, variability of inflation is

attributable to idiosyncratic and often unpredictable shocks.

What

determines inflation’s longer-term trend?

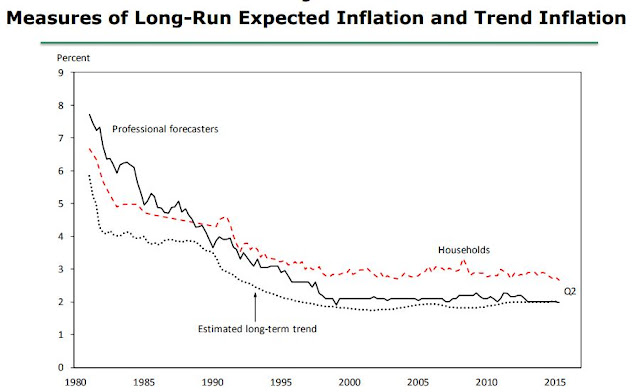

Theory suggests that inflation expectations—which presumably

are linked to the central bank’s inflation goal--should play an important role in

actual price setting. Most theoretical versions of the Phillips curve suggest

that inflation should depend on short-run inflation expectations, but, as an

empirical matter, measures of long-run expectations appear to explain the data better.

Estimated trend in inflation is in fact related to households’ and firms’ long-run

inflation expectations.

Yellen’s

analysis suggests that economic slack, changes in imported goods prices, and

idiosyncratic shocks all cause core inflation to deviate from a longer term trend

that is ultimately determined by long-run inflation expectations. Yellen’s

model of core inflation is a variant of

a theoretical model that is commonly referred to as an expectations-augmented

Phillips curve.

Is

there difference between Neo-Clasics and Neo Keynesian on inflation ?

See Tobin (1972) and Friedman (1968) for early

discussions of the theory underpinning the expectations augmented Phillips

curve. Theoretical descriptions of the inflation process remain an active area

of research in economics. In recent years, many economic theorists have used a

so-called new-Keynesian framework--in which optimizing agents are assumed to

face constraints on price or wage setting in the form of adjustment costs or

explicit nominal contracts--to model inflation dynamics. Although these

new-Keynesian inflation models can differ importantly in their specifics, they

all tend to assign a central role to inflation expectations and resource utilization

as drivers of inflation dynamics.

Why

anchored expectations are important ?

Situation shown in panel A, in which households’ and

firms’ expectations of inflation are not solidly anchored, but instead adjust

in response to the rates of inflation that are actually observed. Such

conditions--which arguably prevailed in the United States from the 1970s to the

mid-1990s--could plausibly arise if the central bank has, in the past, allowed

significant and persistent movements in inflation to occur. In this case, the temporary

rise in the rate of change of import prices results in a permanent increase in inflation.

This shift occurs because the initial increase in inflation generated by a

period of rising import prices leads households and firms to revise up their

expectations of future inflation. A permanent rise in inflation would also

result from a sustained rise in the level of oil prices or a temporary increase

in resource utilization.

Inflation expectations are instead well anchored,

perhaps because the central bank has been successful over time in keeping

inflation near some specified target and has made it clear to the public that it

intends to continue to do so. Then the response of inflation to a temporary

increase in the rate of change of import prices or any other transitory shock

will resemble the pattern shown in panel B. In this case, inflation will

deviate from its longer-term level only as long as import prices are rising.

But once they level out, inflation will fall back to its previous trend in the

absence of other disturbances. A key implication of

these two examples is that the presence of well-anchored inflation expectations

greatly enhances a central bank’s ability to pursue both of its objectives--namely,

price stability and full employment. Because temporary shifts in the rate of

change of import prices or other transitory shocks have no permanent influence

on expectations, they have only a transitory effect on inflation.

How

can we see inflation expectations ?

11-For

households, median long-term expectations from the University of Michigan

Surveys of Consumers; for professional forecasters, expectations derived from survey conducted by Richard Hoey and from the

Survey of Professional Forecasters, conducted by the Federal Reserve Bank of

Philadelphia.

2-Difference between yields on nominal

Treasury securities and inflation indexed ones, called TIPS.

What

do you think Phillips-curve approach to forecasting inflation?

The Phillips-curve approach to forecasting inflation

has a long history in economics, and it has usefully informed monetary policy

decisionmaking around the globe. But the theoretical underpinnings of the model

are still a subject of controversy among economists. Moreover, inflation sometimes

moves in ways that empirical versions of the model.

Yellen’s

last words:

However, we have not yet fully attained our objectives

under the dual mandate: Some slack remains in labor markets, and the effects of

this slack and the influence of lower energy prices and past dollar appreciation

have been significant factors keeping inflation below our goal. But I expect

that inflation will return to 2 percent over the next few years as the

temporary factors that are currently weighing on inflation wane, provided that

economic growth continues to be strong enough to complete the return to maximum

employment and long-run inflation expectations remain well anchored.

Dr. Engin YILMAZ

14.10.2017

Ankara

Yorumlar

Yorum Gönder